14.12.2022

In Focus: Hedge funds - Eine Alternative zu Fixed Income oder Aktionen?

Hedge funds – an alternative to Fixed Income or Equity?

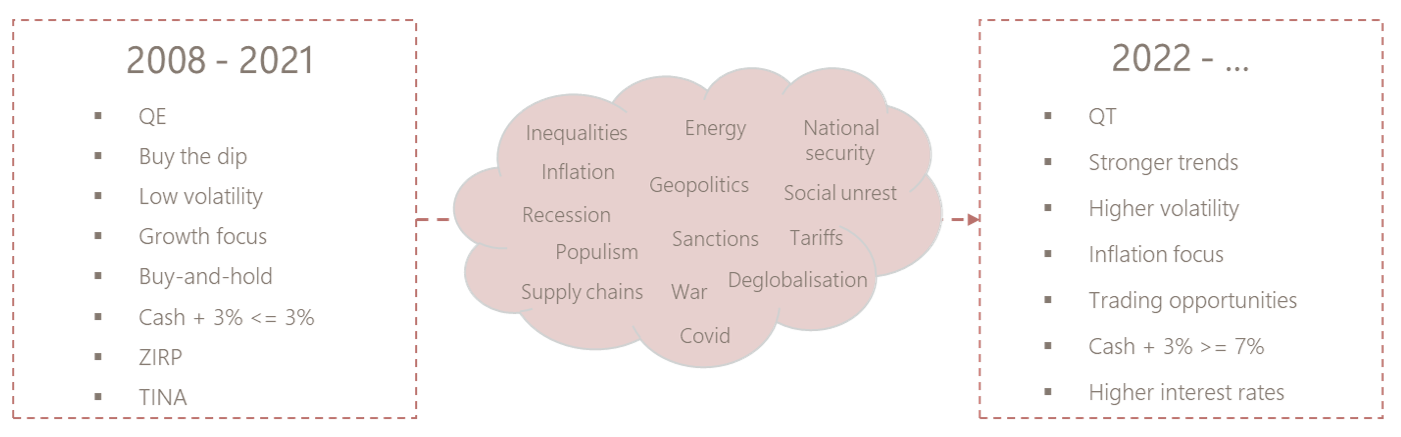

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

Mehr Publikationen

20.02.2025

EFG International x Cité Gestion

Wir freuen uns, bekannt geben zu können, dass sich Cité Gestion vorbehaltlich der Genehmigung durch die FINMA mit der EFG Group, der sechstgrößten Privatbankengruppe in der Schweiz, zusammenschließt.

Cité Gestion wird als unabhängige Einheit agieren und ihren Namen, ihre Governance und ihre Teams beibehalten. Sie wird durch die von EFG angebotene globale Reichweite und Kapazitäten gestärkt, die es ihr ermöglichen werden, ihr Wachstum zu beschleunigen.

Mehr dazu13.02.2025

GPM SA x Cité Gestion

Nach über 15 Jahren Engagement für ihre Kundschaft danken wir Catherine de Steiger und Imad Ghosn, ehemalige Partner von GPM SA, dass sie uns ausgewählt haben, um die Kontinuität ihrer Mission zu gewährleisten.

Wir freuen uns darauf, ihre Kunden mit der gleichen Nähe zu begleiten und wünschen ihnen alles Gute für ihren weiteren Weg.

Mehr dazu31.01.2025

Le Temps x Cité Gestion

Was ist der nächste Zug der Schweiz auf dem globalen Schachbrett?

Ein Rückblick auf das Horizon 2025 Forum, das am 30. Januar 2025 am IMD stattfand.

Mehr dazu27.01.2025

Rückblick auf unsere Veranstaltung in Davos

Wir freuen uns, dass wir unsere allererste Veranstaltung in Davos am Rande des World Economic Forum Annual Meeting zum Thema « Governance als Motor für Investmentperformance » mit Professor Didier Cossin vom IMD durchführen konnten.

Mehr dazu15.01.2025

Alexandra Kosteniuk x Cité Gestion

Wir gratulieren Alexandra Kosteniuk, die sich mit ihrem sechsten Platz bei den Weltmeisterschaften und ihrer Bronzemedaille bei den Europameisterschaften hervorgetan hat.

Mehr dazu