14.12.2022

In Focus: Hedge funds – An alternative to Fixed Income or Equity?

Hedge funds – an alternative to Fixed Income or Equity?

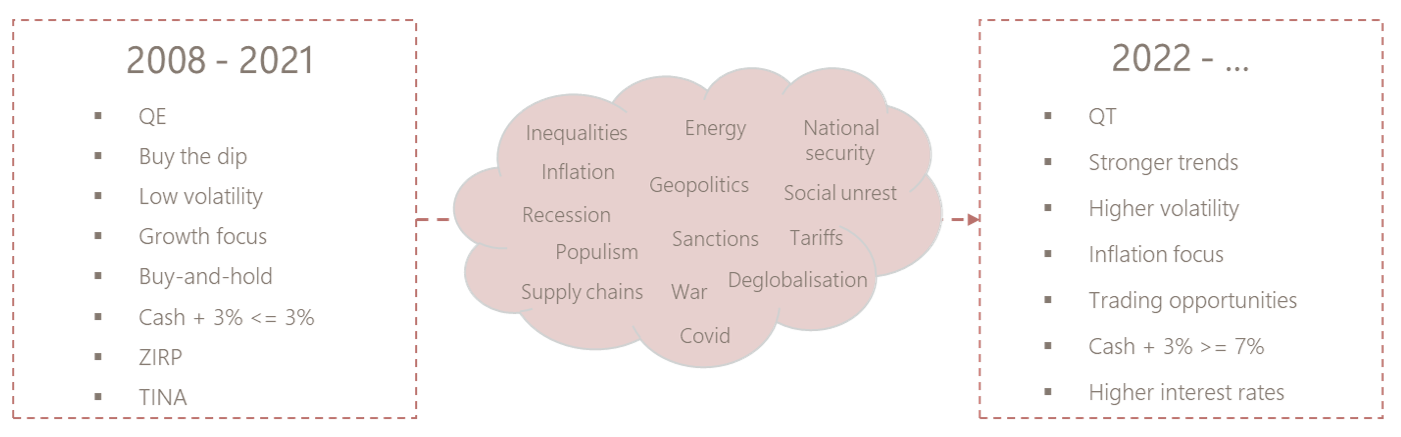

Dealing with the consequences of the global financial crisis of 2008, major central banks slashed interest rates and injected unprecedented amounts of money in the economy to save it from depression. Accordingly, interest rates reached record low levels, equity returns skyrocketed above historic averages and the negative correlation between bonds and equities made 60/40 portfolios a strategy of choice. The TINA (there is no alternative) mantra – there is no alternative to equity, and the Search for Yield prevailed. In that environment, hedge funds were used as a risk management tool, an alternative to non-yielding fixed income, at perceived high cost relative to their realised below average return.

Fast forward to today, the world has structurally changed. Interest rates are back to 2007 levels, we are witnessing the return of inflation, volatility is higher in most asset classes, and sustainable trends have allowed CTAs and macro managers to outperform. The environment is just more favourable to many hedge fund strategies, if not all of them. Higher interest rates are positive for all cash + spread strategies. Arbitrageurs have more opportunities as volatility periodically pushes price relationships out of sync. Dispersion among equities is in favour of skilled stock pickers. The re-shoring of activities, the rise of China, the rethought role of energy, climate transition and the rebalancing of geopolitical powers are a fertile ground for macro managers. Finally, the looming recession is likely to offer new opportunities for distressed managers in due time.

The next 10 years will most probably not look like the past 10 ones. Equity returns were frontloaded with the help of central banks’ quantitative easing. Going forward, quantitative tightening is likely to affect expected returns in the opposite way. In the years to come, hedge funds, particularly “uncorrelated” strategies, will continue to compete with Fixed Income for the role of “diversifier” in the portfolios, even if bonds are no longer yielding close to zero. At the same time, for the first time since global financial crisis, hedge funds have good chances to produce better returns than equities. Already this year, hedge funds proved again their usefulness in portfolios. Non-directional strategies performed the best, and we would favour those to complement multi-asset portfolios.

More articles

01.04.2025

Four new partners appointed at Cité Gestion

We are delighted to announce the appointment of Alberto Cervantes, Matija Jankovic, José Prieto and Claude Salvador as Partners. Their exemplary career paths, passionate commitment and keen sense of service embody the entrepreneurial spirit that we cultivate at Cité Gestion.

Read more24.03.2025

Ian Hauri and Felix Svensson x Cité Gestion

We are proud to continue to support Ian Hauri and Felix Svensson, two young Swiss talents who continue to progress and shine in their respective disciplines.

Read more04.03.2025

The Swiss Experience x Cité Gestion

We were delighted to welcome Brazilian legal practitioners to Geneva as part of The Swiss Experience. A rich exchange of views on finance and cross-border issues, strengthening the ties between Switzerland and Brazil !

Read more20.02.2025

EFG International x Cité Gestion

We are pleased to announce that Cité Gestion has joined forces with EFG Group, the 6th largest private banking group in Switzerland, subject to FINMA approval.

Cité Gestion will operate as an independent entity, retaining its name, governance and teams. It will be strengthened by EFG's global reach and capabilities, which will enable it to accelerate its growth.

Read more