03.05.2022

In Focus: La curva dei rendimenti del Tesoro USA manda segnali contrastanti | Maggio 2022

In the early days of the month of April, the closely watched 2Y/10Y yield curve has inverted multiple times over a short time span. High emphasis is put on this point of data as it has in the past often been synonymous in announcing a recession of the US economy. While many strategists explained that the rise in concern over this matter should not spark fear in the markets, others highlight putting the 2Y/10Y in correlation with the Consumer Optimism Gap clearly illustrates that a downward slopping yield curve matches a fall in consumer optimism and eventually provides fertile ground for a recession.

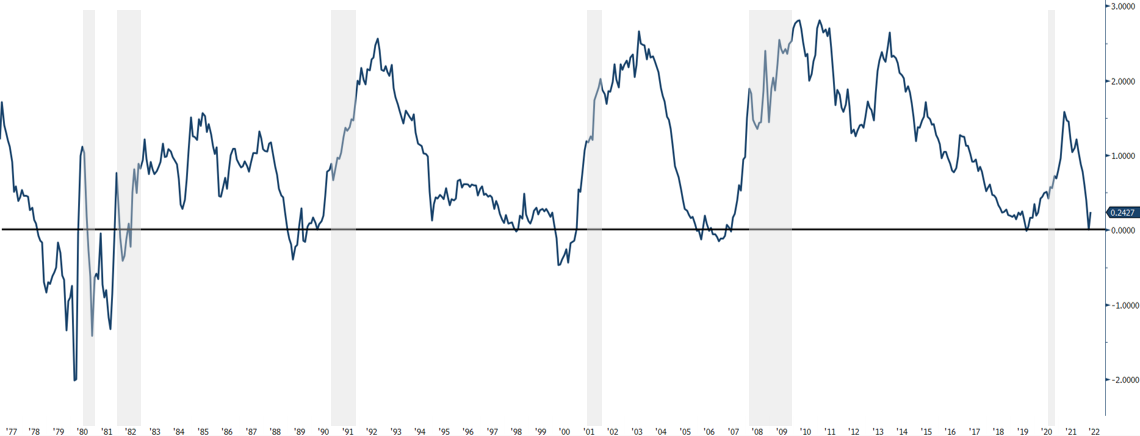

US 2Y/10Y - Average of 18 months from inversion to recession:

History tells us since the 1960s’ every recession where economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters has only occurred after an inversion of the 2Y/10Y. Following this chain of thought, we can now suppose that additional risk is weighing in the basket in seeing a declining growth of the US economy in one to two years time.

US 2Y/10Y vs Consumer Optimism Gap:

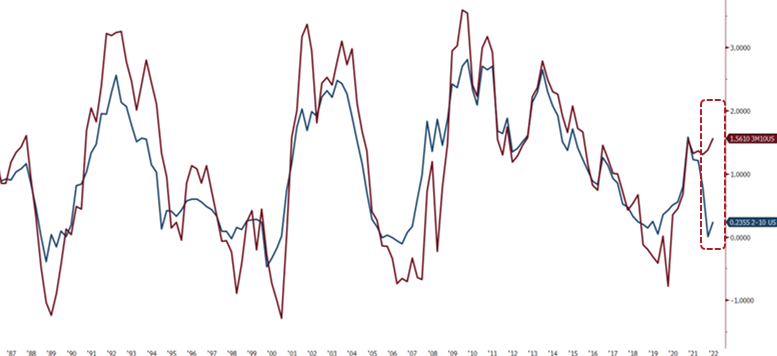

Don’t panic the 3M/10Y still remains steep

All yield curves between 2 and 10 years have inverted. Remains the 3 month, which is taking a steep route in positive territory. This phenomenon can be interpreted in two ways. The first could be a reflection of the FED being behind the curve. Something that should not last over the upcoming quarters as future hikes are on target following the rise of the 4th of May.

An upward slopping curve happens when investors require additional return on debt as they envision greater default risk of the underlying or a possible fear of inflation. The divergence between the 3M/10Y could also be a signal of increasing hawkishness from the FED in the upcoming years.

Finally, while some mention an inversion of the 2Y/10Y leaves us on average more than a year and half to face a potential recession, it is worth highlighting that a recession occurring after a 1st rate hike in a cycle happens earlier when the 2Y/10Y inversion occurs during the hiking cycle. The last inversion of March 2022 occurred in the quickest time span recorded after the start of the hiking cycle.

US 3M/10Y vs 2Y/10Y:

Asset class performance post-inversion

The average performance post inversion of the S&P 500 does not show cast a clear pattern. No correlation can be established between the inversion and performance of US stock index before, during and after a cycle.

We should bear in mind that short and long-term dynamics shape the yield curve. Two years ago, before the COVID-19 outbreak the FED has cut its policy rate to near zero in order to limit the impact of a recession caused by the pandemic.

Fast forward to today’s terms, the FED has to “catch up” with growing inflation as both global and US economy recovers to its pre-pandemic levels. The T-Bill is facing strong global demand combined to the FEDs’ ongoing quantitative easing (QE) that has for effect to increase prices of bonds resulting in low yields. The steepness of short-term yields has caught a great deal of attention, ultimately opening the debate of future economic outlook on either an unconventional slowdown in growth or a strong signal of a US recession; the question remains open.

Altri articoli

26.01.2026

Benvenuto a Norma Hedinger!

Siamo lieti di annunciare l’arrivo di Norma Hedinger come banchiera presso Cité Gestion.

Leggere tutto21.01.2026

Intelligenza artificiale in medicina: il punto di svolta è arrivato.

Cinque anni fa, l’IA in medicina sembrava una promessa. Oggi sta diventando un’industria.

Leggere tutto13.01.2026

Benvenuto a Raffael Iberg!

Siamo lieti di annunciare l’arrivo di Raffael Iberg come Investment Advisor presso Cité Gestion.

Leggere tutto07.01.2026

Outlook 2026 – Dopo l’anno della 3D, benvenuti nello scenario dei 3R!

Dopo due anni eccezionali per i mercati, il 2026 non è sinonimo di euforia – è l’anno dei 3R: Rivalutazione, Rotazione e Resilienza.

Leggere tutto30.12.2025

A nome di tutto il team di Cité Gestion: Felice Anno Nuovo 2026!

Poiché il 2025 è stato un anno intenso per il mondo finanziario, desideriamo ringraziarvi per aver continuato a seguirci con interesse.

Leggere tutto

25.12.2025

Uno sguardo all’anno 2025

In questa giornata particolarmente festosa, desideriamo cogliere l’occasione per ripercorrere i risultati e le esperienze che abbiamo condiviso nel 2025.

La vostra fiducia, unita all’impegno dei nostri collaboratori, ha fatto davvero la differenza nel corso di quest’anno.

Vi ringraziamo sinceramente e vi auguriamo un Buon Natale!

Leggere tutto