04.11.2021

Finance comportementale chez Cité Gestion

According to a recent study done by KPMG and the University of St. Gallen, the consolidation in Swiss private banking continues. Whereas there were 163 banks in 2010, there are 96 banks left in 2021. The number of private banks in Switzerland is declining. This is a result of falling margins and the need for economies of scale. Operating income margins fell at 83% of banks in 2020. The picture is similar for independent wealth managers, especially those who do not have the critical mass. Negative interest rates also have a toll on the profitability of the industry. Net new money in Swiss private banks, however, has hit the highest level since 2010, with CHF 94.5bn, or a 3.3% rise in 2020.

In such times, what is most important in our business is often neglected: the client’s needs. A wealthy person who decides to entrust his or her wealth to a Swiss private wealth manager has a long list of individual needs and expectations. In almost every case, however, a good risk-adjusted return of the portfolio and an asset allocation that produces the expected outcomes are among the must-haves.

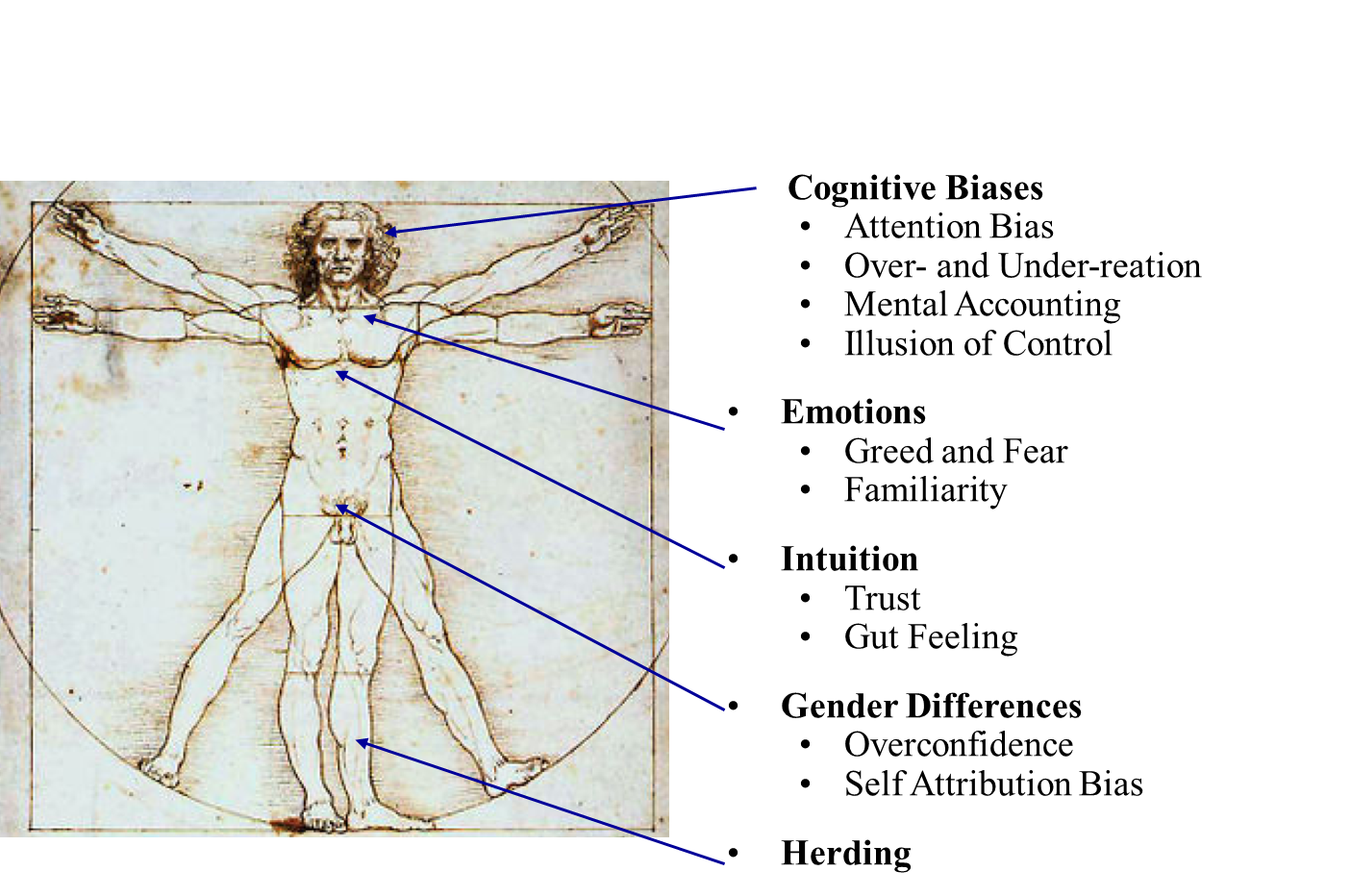

There are different ways to achieve and improve these core-needs. A key factor to mention is the awareness of how the human psychology can affect investment decisions negatively. Incorporating concepts of behavioral finance can help address this.

Behavioral finance offers an alternative approach to standard finance. Whereas standard finance assumes that investors are rational and markets are efficient, according to behavioral finance investors are just “normal”, not rational, and markets are not always efficient, even if they are difficult to beat. The behavior of humans is often characterized by psychological and emotionally driven factors. Many of these factors lead to suboptimal investment decisions and can affect portfolio returns negatively. A well-known example is the so-called prospect theory according to which individuals adapt their risk behavior depending on the situation. A famous experiment conducted by Kahneman and Tversky in 1979, and which has been confirmed by many subsequent experiments, has shown that individuals are risk-averse towards gains and risk-seeking towards losses. The participants in the experiment preferred a small safe gain in a profit-oriented situation and chose the riskier alternative in a loss-oriented situation.

In 2021, Cité Gestion has concluded a behavioral finance project with the Department of Banking and Finance of the University of Zurich under the supervision of Prof. Thorsten Hens. The aim was to see if there are behavioral biases in our investment process. In addition, if there are behavioral biases, do they have a negative impact on portfolio returns?

Cité Gestion provided the University of Zurich with a set of data covering the period from February 2019 to February 2021. Using this data, the researchers were able to detect the presence of several statistically significant behavioral biases in investment decisions at Cité Gestion. The study went on to check whether the presence of these behavioral biases is impacted by advisor involvement, as measured by type of mandate (execution only, advisory or discretionary), and the investors’ risk propensity as measured by the risk-profile (conservative, balanced and growth).

Several well-known behavioral biases were detected at Cité Gestion. Among these are overconfidence, adaptive behavior, attention bias and affinity bias. Overconfidence, for example, is measured by the turnover in a given portfolio. A higher turnover indicates that the person taking the investment-decisions is over-confident as he or she trades a lot. Larger trade size indicates conviction as the person investing is willing to put more capital into one single investment. The affinity bias, for example, is present when a portfolio has a large chunk of investments in the “home country”, a situation that is usually called “home-bias”.

The overconfidence bias present in Cité Gestion investment decisions had only a small negative impact on overall returns. However, the affinity bias which manifests itself in portfolios with a home-bias is costly in terms of performance as accounts with a higher home-bias had a statistically significant lower return. Finally, well-diversified portfolios, which are the contrary of portfolios with large positions and home-bias, had better returns than less diversified portfolios. We thus learned that we could improve performances by avoiding behavioral biases that lead to home-bias and under-diversification.

The outcome of the study also showed that portfolios, which are managed by professional advisors, suffered less from “overconfidence” in the form of “conviction” and “under-diversification”: these portfolios had less concentration risk, e.g. large positions in single securities, and were better diversified than portfolios managed by the clients themselves. On one hand, the involvement of an advisor proved to be positive for portfolio returns. On the other hand, we learned that advisor involvement led to a stronger “home bias” in security selection. This had a negative impact on returns. Regarding the latter, it remains to be seen whether this is true over longer time-periods, too.

At Cité Gestion, we used the results of this academic research to improve our investment process and to reduce the negative impact of behavioral biases on portfolio returns. To address the “overconfidence” and “under-diversification” biases we decided to increase the headcount of our investment advisor desk. With a growing number of clients seeking investment advice at Cité Gestion, we needed to adapt the number of investment specialists. In order to reduce the “home-bias”, which increases with the involvement of advisors, we have created model portfolios which have the same global diversification independent of their base-currency and which invest in a rather passive way. The aim of these portfolios is to avoid “home bias” and to provide advisors and clients with an asset allocation solution that is highly diversified.

Finally, while the study done by the University of Zurich detected the existence of various behavioral biases at Cité Gestion, it also showed that Cité Gestion loses less money due to these behavioral biases than other asset managers.

The study of behavioral biases in our investment process is just one example of how we strive to improve the service to our clients. It is an illusion to have the perfect and unmatched offering for private wealth clients. However, who doesn’t try to learn and improve will definitively stay “behind the curve”.

In spite of these challenging times, Cité Gestion has managed to grow steadily. Assets under management reached CHF 5.5bn, thereby quasi tripling in less than three years. With its 80 employees, the company continues to hire and invest in the future by continually improving its investment process.

Autres publications

24.03.2025

Ian Hauri et Felix Svensson x Cité Gestion

Nous sommes fiers de continuer à soutenir Ian Hauri et Felix Svensson, deux jeunes talents suisses qui ne cessent de progresser et de briller dans leurs disciplines respectives.

Lire plus04.03.2025

The Swiss Experience x Cité Gestion

Nous avons eu le plaisir d’accueillir des praticiens du droit brésilien à Genève dans le cadre de The Swiss Experience. De riches échanges sur la finance et les enjeux transfrontaliers, renforçant les liens entre la Suisse et le Brésil !

Lire plus20.02.2025

EFG International x Cité Gestion

Nous avons le plaisir d'annoncer que Cité Gestion s’allie au Groupe EFG, le 6ème plus grand groupe de banque privée en Suisse, sous réserve de l'approbation de la FINMA.

Cité Gestion agira comme une entité indépendante en conservant son nom, sa gouvernance et ses équipes. Elle sera renforcée par la portée et les capacités mondiales offertes par EFG, qui lui permettront d’accélérer sa croissance.

Lire plus13.02.2025

GPM SA x Cité Gestion

Après plus de 15 ans d’engagement auprès de leur clientèle, nous remercions Catherine de Steiger et Imad Ghosn, ex-associés de GPM SA, de nous avoir choisi pour assurer la continuité de leur mission.

Nous nous réjouissons d'accompagner leurs clients avec la même proximité et leur adressons nos meilleurs vœux pour la suite de leur parcours.

Lire plus