09.10.2020

How much risk is priced-in ahead of the US election?

There is no doubt that a US presidential election represents a risk for financial markets and a good way to quantify how much risk is currently priced-in is to look at the forward implied volatility before and after the elections.

For that, the VIX index, a basket of the S&P 500 options volatility, sounds a good barometer.

Looking at the VIX curve, The November expiry is currently trading 1.5% above the December one, reflecting the immediate risk investors are facing post-election (November 3rd) relative to December.

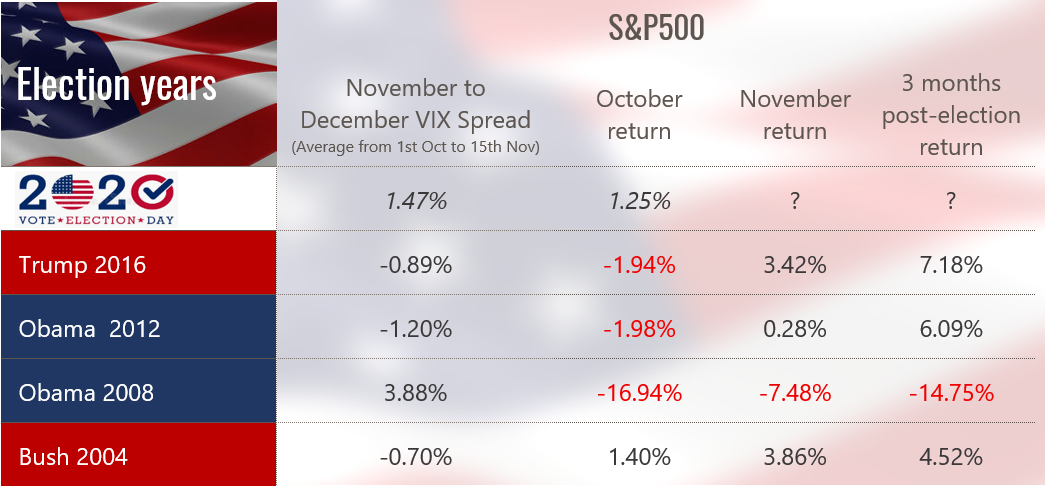

While the 1.5% spread indicates a higher implied risk around and after the election, it does not quantify the absolute level of risk. To put it in perspective, we looked at the average November-December VIX Spread from October 1st to November 15th for every US Election since 2004.

Excluding the US election during the Great Financial Crisis in 2008 where spot volatility was structurally higher than 1, 2 and 3 months forward, it appears that a positive November/December VIX Spread is somewhat unusual. In fact, during the 2004, 2012 and 2016 elections, the November VIX never traded above the December one.

Looking at the return of the S&P in October, November and 3 months after the election, we can observe that it is very difficult to draw any conclusion over a US presidential election from a financial market perspective. If anything and excluding the 2008 election during the crisis, the simple and most direct conclusion would be that a US presidential election after 2000 had a positive impact on the S&P 500 Index one month and 3 months after the outcome.

So how to explain this extra-risk this time? We believe the 1.5% premium in November volatility relative to December likely reflects one single risk: if Biden wins, President Trump might not going to accept it. A sentiment that has been reinforced after the first TV debate of the US elections.

To conclude, history shows that financial markets can easily deal with a republican or democrat president but definitely not with no President after November 4th.

More articles

01.04.2025

Four new partners appointed at Cité Gestion

We are delighted to announce the appointment of Alberto Cervantes, Matija Jankovic, José Prieto and Claude Salvador as Partners. Their exemplary career paths, passionate commitment and keen sense of service embody the entrepreneurial spirit that we cultivate at Cité Gestion.

Read more24.03.2025

Ian Hauri and Felix Svensson x Cité Gestion

We are proud to continue to support Ian Hauri and Felix Svensson, two young Swiss talents who continue to progress and shine in their respective disciplines.

Read more04.03.2025

The Swiss Experience x Cité Gestion

We were delighted to welcome Brazilian legal practitioners to Geneva as part of The Swiss Experience. A rich exchange of views on finance and cross-border issues, strengthening the ties between Switzerland and Brazil !

Read more20.02.2025

EFG International x Cité Gestion

We are pleased to announce that Cité Gestion has joined forces with EFG Group, the 6th largest private banking group in Switzerland, subject to FINMA approval.

Cité Gestion will operate as an independent entity, retaining its name, governance and teams. It will be strengthened by EFG's global reach and capabilities, which will enable it to accelerate its growth.

Read more